The increasing demand for health-related products and the expansion of cross-border e-commerce have resulted in a significant influx of foreign nutritional products into the Chinese market. In 2023, reports indicated that China's cross-border import e-commerce reached an impressive 548.3 billion yuan, with nutritional supplements emerging as a prominent category, boasting a purchase rate of nearly 40% over the past year. However, this growth has been overshadowed by frequent trademark disputes, which not only jeopardize the hard-earned reputations of various brands but also pose substantial challenges to the healthy and orderly development of the market.

Neurio: Navigating Trademark Rights Risks in Cross-Border Partnerships

In mid-March of this year, the Fuzhou Court, in collaboration with the Rongcheng Customs Office and the Fuzhou Market Supervision Administration, executed a large-scale destruction operation related to a trademark infringement case involving the nutritional product brand "Neurio." This operation resulted in the destruction of 6,138 cans of platinum and immune versions of lactoferrin formula milk powder labeled "JAT." The dispute centers around Guangzhou Aotiva Biotechnology Co., Ltd. (referred to as "Aotiva"), which uses the "NRI" label, and Australia's Sunnya Pty Ltd (referred to as "Sunnya"), which uses the "JAT" label, both of which are contesting the ownership of the "Neurio" trademark.

It is noteworthy that these two companies have been entangled in this issue for two years. Since 2023, Aotiva and Sunnya have been engaged in a legal battle over trademark rights, with both parties and their distributors involved in at least ten lawsuits across domestic and international courts, excluding appeals.

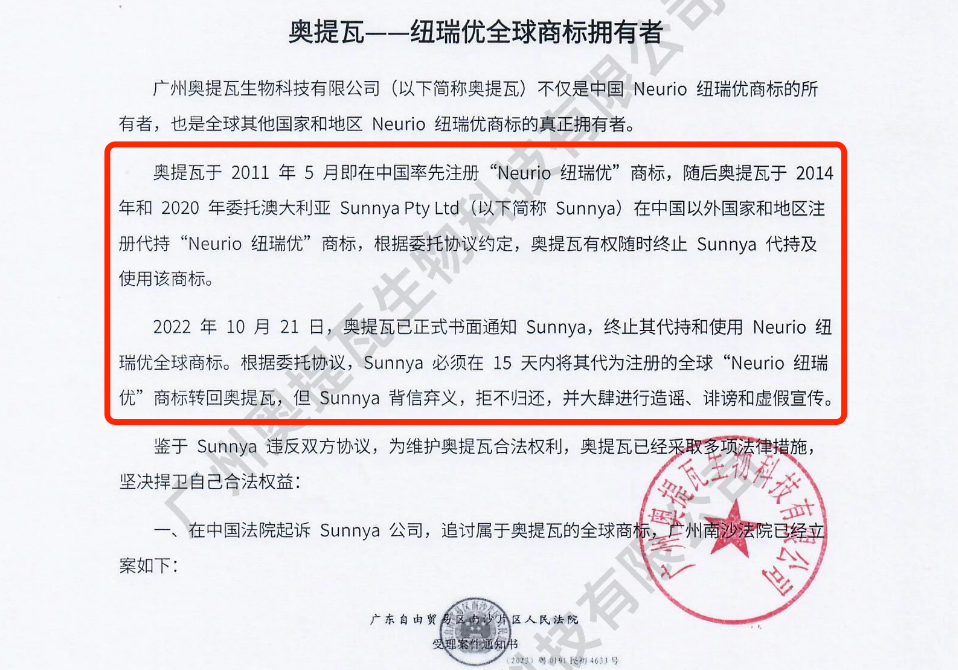

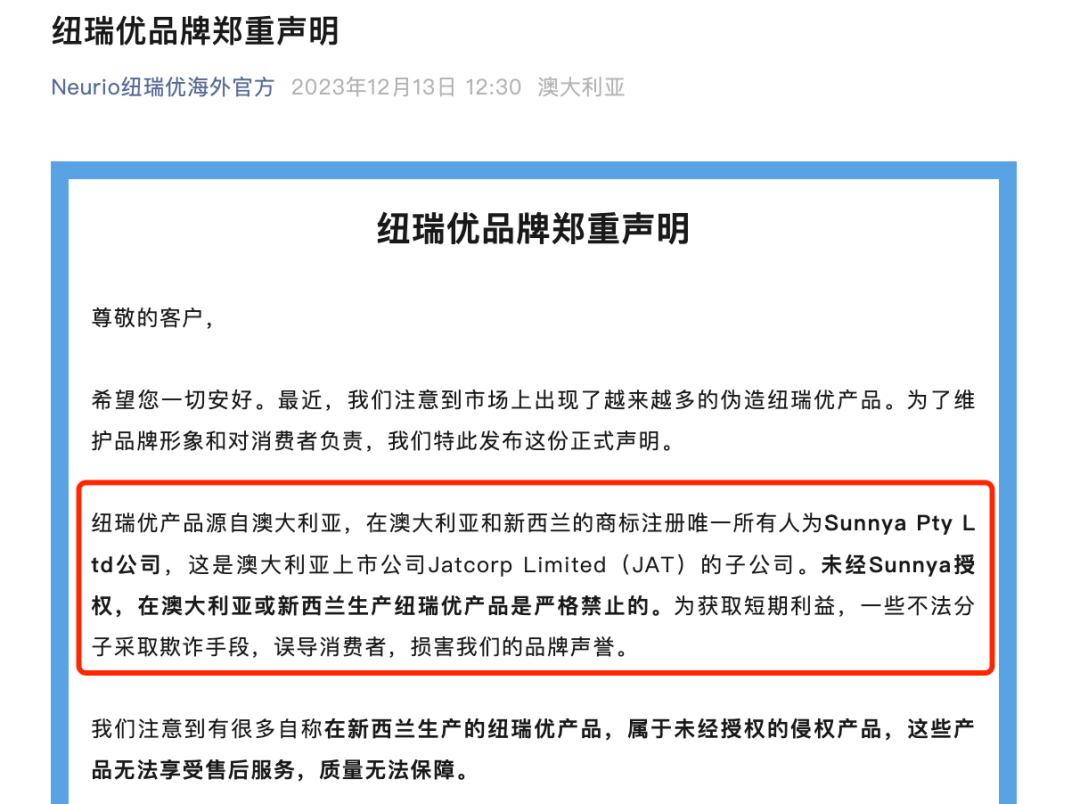

Aotiva claims to have registered the "Neurio" trademark in China in 2011. In 2014 and 2020, Aotiva entrusted Sunnya with the registration and management of the "Neurio" trademark in regions outside of China. However, the agreement allowed Aotiva to terminate Sunnya's use of the trademark at any time. The partnership deteriorated due to JAT's involvement, and on October 21, 2022, Aotiva revoked Sunnya's rights to the Neurio global trademark. Sunnya, however, allegedly breached the contract and retained control. Sunnya asserts that it established the Neurio brand in Sydney, Australia, in 2014, and that it was acquired by the Australian company JAT in 2018. The trademark registration for Neurio in Australia and New Zealand is solely owned by Sunnya, and any production of Neurio products in those regions without Sunnya's authorization is prohibited. Aotiva previously served as a distributor for Sunnya in mainland China.

As of March this year, official reports indicate that Aotiva has won six cases, while Sunnya has secured victories in approximately two. Courts have ruled that trademark rights are territorial and only effective in the regions where they are registered. Therefore, to determine if a product infringes on trademark rights, it must be assessed based on whether the label used has been authorized by the domestic registered trademark holder and whether the label and product are identical or similar to those of the registered trademark holder.

Interestingly, Aotiva and Sunnya were once closely linked, as Sunnya was founded by Lu and He, who were shareholders of Aotiva at the time. Initially, under Aotiva's management, Sunnya handled procurement in Australia while Aotiva managed sales in China. In 2018, JAT acquired 51% of Sunnya's shares, but the "Neurio" trademark was held personally by Lu. Due to various circumstances, Lu authorized Sunnya to use the trademark. However, following changes in JAT's senior management, the relationship between Aotiva and JAT, along with Sunnya, deteriorated, leading to the current trademark dispute.

While this trademark dispute remains unresolved, the ongoing struggle over the Neurio trademark highlights the critical importance of a well-defined trademark strategy in cross-border collaborations.

Childhood Time: The Trademark Dispute Between Agents and Brands

The case of "Childhood Time" has recently come to light due to trademark disputes. Nanjing Childhood Time Biotechnology Co., Ltd. (hereafter referred to as "Nanjing Childhood Time") was the operator of the American brand ChildLife's products from 2013 until 2020. In 2021, the company transitioned to representing the German children's nutrition brand, inne. However, the use of the registered "Childhood Time" trademark during the operation of both brands led to consumer confusion, prompting an official trademark dispute.

The American ChildLife brand highlighted that in 2009, Lu Qidong, while employed by a third-party company, began engaging with the ChildLife brand. By 2010, this third-party company had become the exclusive agent and distributor for ChildLife in mainland China, as well as in Hong Kong and Macau. In the same year, Lu Qidong, along with his wife Guo Zhijuan and brother Lu Qifeng, established Nanjing Childhood Time, with Guo Zhijuan serving as the legal representative and executive director. Unbeknownst to the ChildLife brand, they registered the trademarks "Childhood Time" and "ChildLife." In 2011, Nanjing Childhood Time became a secondary distributor under the third-party company, which withdrew in 2012. By 2013, Nanjing Childhood Time had officially become the primary distributor for ChildLife in China, leading to nearly a decade of online marketing efforts in the mainland market, where "Childhood Time" was consistently associated with ChildLife products.

In response, Nanjing Childhood Time asserted that it applied for the "Childhood Time" trademark in April 2010, successfully registering it in 2011. They noted that ChildLife did not have a corresponding Chinese trademark prior to 2011 and subsequently adopted "Sai'erle" as its Chinese trademark for sales and promotions. They emphasized that their cooperation began in 2013, during which the "Childhood Time" trademark was used for ChildLife products. Nanjing Childhood Time maintained that "Childhood Time" and "ChildLife" are distinct entities and independent brands. With the end of their cooperative relationship, they clarified that there is no longer any affiliation between the two.

The trademark dispute remained unresolved for nearly three years, culminating in a court ruling at the end of 2023. The Hangzhou Intermediate Court determined that the simultaneous application for the "Childhood Time" and "CHILDLIFE" trademarks on April 20, 2010, was not coincidental. The court recognized that products bearing the "Childhood Time" and "CHILDLIFE" anti-counterfeiting labels had gained significant recognition through years of use and sales. Consequently, the use of "Childhood Time" in inne products was deemed unauthorized, as it infringed upon the established product name of another party. Following this ruling, the inne brand issued a statement affirming its independence and clarifying that its current products do not infringe on any rights.

Presently, the operation of inne involves several companies, including Guo Zhijuan's Hong Kong Mama Garden Limited, Lu Qifeng's Nanjing Green Wild Fairy Tale Biotechnology Co., Ltd., and Guo Guilin's Nanjing Childhood Time Biotechnology Co., Ltd. This trademark dispute between the German inne and American ChildLife highlights various contradictions between agents and brands concerning trademark usage, quality control, and business ethics.

Rise of Cross-Border Trademark Disputes Highlights the Need for Enhanced Trademark Protection

It is important to recognize that cross-border trademark disputes are becoming increasingly common. For instance, Wyeth LLC and Guangzhou Wyeth Baby Products Co., Ltd. have been involved in a prolonged intellectual property conflict over the trademarks "Wyeth" and "惠氏." Similarly, Haibabudou Children’s Products Co., Ltd. and Quanzhou Babudou Children’s Products Co., Ltd. have faced significant disputes regarding the "BABUDOG and design" trademark. These cases serve as a crucial reminder for the nutrition industry and all sectors engaged in cross-border trade. As market participants, companies bear the primary responsibility for safeguarding their trademarks.

In our globalized economy, it is essential for businesses to establish a comprehensive trademark protection strategy. This includes clearly defining trademark ownership in partnerships and implementing thorough agreements regarding trademark usage and protection to prevent disputes. These issues extend beyond corporate interests; they also impact consumer rights and the overall health of the market. From a consumer standpoint, trademark disputes can create confusion, raise concerns about product quality, and complicate the process of asserting rights. From a distribution perspective, trademark inconsistencies can disrupt fair competition and hinder the healthy growth of distribution channels. Given the prevalence of import and export trade today, this is a pressing concern.

According to the "2024 Survey on Overseas Intellectual Property Disputes of Chinese Enterprises" published by the China Intellectual Property Research Association, Chinese enterprises engaged in 1,762 intellectual property litigation cases in the United States in 2023. Of these, 1,119 were trademark-related, with 757 new cases filed, marking a 5.43% increase from the previous year, and 815 cases concluded. This data underscores the necessity for companies to enhance their awareness and practices regarding intellectual property protection as global trade continues to evolve.